Fabric Midyear Financial Update

We are slightly ahead of budget at the midpoint of our fiscal year. We are monitoring a recent decrease in monthly autogiving & making progress to fill a significant gap caused by the loss of a large special gift.

This year’s budget is just over $401K. Midway through the fiscal year, we are ahead of budget by about $3,600 and have drawn down less than budgeted from reserves. Staff are managing expenses carefully.

Because some of our income is seasonal, we had projected an operating deficit of $9,266 at this point in the fiscal year. Projected income from the Spring Giving Challenge in April and May is budgeted to close that deficit. Our savings allows us to manage cash flow.

The annual budget projected a nearly $49K income gap due in large part to the loss in late 2023 of a historically reliable gift that had comprised nearly 8% of our annual income. The Board approved using reserves to fill the gap, while committing to pursuing new grant and income opportunities.

In January we secured a very generous grant from Southside Commons Legacy Fund. The grant primarily supports new marketing and outreach efforts intended to reach folks who are looking for a community like Fabric. Some of the funds, though, can be used 1) for budgeted expenses related to marketing/outreach and 2) as incentives to meet our Spring Giving Challenge goals. This will reduce the amount we had budgeted to draw down on reserves.

While our autogiving income had been running slightly above budget, since the start of 2025 there has been a decrease in autogiving to about $500 under budget per month. Additionally, we’re at a 9-year low in the number of autogivers.

Looking Ahead

February 14 marked Ian’s one-year anniversary with Fabric!! Our incredible staff will be moving into new office space on April 1 that reflects a vision of growth and community connection. Our community is energized with new friends and inspiring, thoughtful, relevant conversations.

We are launching a multimedia marketing effort so more people can learn about Fabric. Come to What’s Up With Fabric on April 13 to envision together our roles in welcoming new folks to Fabric.

Our yearly Spring Giving Challenge launches on April 10. We have budgeted to raise $30K in one-time gifts and increase autogiving by $1500/month with a goal of participation by 100 donors. We will share more information about incentive funds from the Southside Commons Legacy Fund.

What You Can Do

Participate in our Spring Giving Challenge April 10-May 5!

New Fabric merch is coming soon to help spread the word about Fabric. Additionally, share ideas, livestream links, podcasts, and social media posts with others.

Intentionally reassessing your participation in and level of autogiving at regular intervals like during the Giving Challenge allows you to recalibrate your commitment.

Wrestling with/wondering about your financial commitment to Fabric and/or to other organizations your values align with can be a lonely, awkward endeavor. Fabric is committed to having hard conversations, including conversations about money. If you are wrestling or have questions, email katy@fabricmpls.com.

Contact Fabric’s Treasurer Laureen Harbert (laureen.tews@gmail.com) with questions about Fabric’s finances and budget.

Fabric Financial Facts

Budget Essentials:

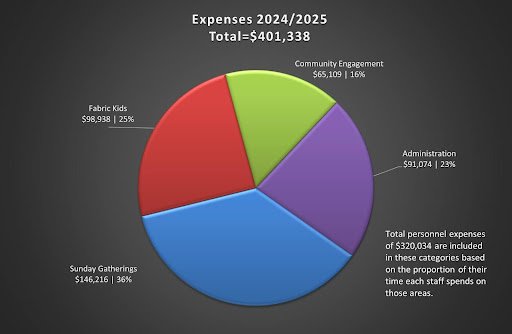

Fabric’s fiscal year is September 1-August 31. Our annual operating expenses are typically $390-400K. See details in the income and expense pie charts below.

While Fabric historically has been funded entirely by our community and friends of Fabric, last fiscal year we spent ~$47,500 in reserves and one-time COVID-related funds to close a budget gap. The gap predates our pastor transition and was largely related to the unanticipated loss of a historically reliable $30K special gift from a friend of Fabric.

Currently, we are projecting to draw down another $26K from our $103K balance of COVID-related funds in the current fiscal year. This is $23K less than we had budgeted because we recently secured a very generous grant, some of which can be directed towards operating funds.

We continue to pursue other grant opportunities.

We have the equivalent of 4.6 FTE staff. Personnel costs (salaries/benefits/payroll taxes) make up 80% of our expenses.

Monthly autogiving makes up ~60% of our budget and provides steady reliable income. As of January 2025, 57 households are enrolled in autogiving. This represents about 67% of households considered Fabric “regulars” as well a handful of Fabric friends.

As is true for many organizations, a small number of large donors contribute a substantial portion of our income. If circumstances for one or more of those supporters change, it has a huge impact.

About 15% of autogiving households contribute 50% of monthly autogiving income.

We are fortunate to have some outside sources of income, including from friends who believe in Fabric, bank interest, and occasional grants. If our operating expenses were supported only by Fabric regulars, on average each household would need to contribute about $4800 annually.

We don’t own a building, which can be a large and unpredictable part of many churches’ budgets. However, just over 10% of our budget is spent on our office rent and costs related to gathering at Field.

FABRIC FINANCIAL UPDATE & 2024-25 FINANCIAL GOALS - NOV 2024

2024-2025 Financial Goals

We have made it through the first eight months of our pastor transition with fairly steady attendance, stable giving, and a great response to our Spring Giving Challenge. A major focus for Ian, the Board, the Stewardship Team and our community this year must be making significant strides in diversifying and shoring up our income.

Board Goal: Diversify and grow our income in a sustainable way through grant applications, increasing the size of our community, and fostering relationships with existing and new major donors.

Measurable Outcome: Reduce the drawdown on one-time funds by $39,000 (from budgeted $49K to $10K) by 8/31/2025.

Strategies:

Increase the number of people in the Fabric community

Research and apply for grants (ELCA, SouthSide Commons, American Camp Association)

Raise awareness about finances and stewardship

Meet with donors and potential donors

Regularly monitor our progress in closing our income gap and plan for contingencies as needed

What Can You Do:

Share your ideas/questions about our finances or stewardship efforts

Participate in Give to the Max through November 21st ($7500 goal; matching gift sponsor(s)?)

Contribute to our marketing efforts (join the team, spread the word about Fabric)

Join the Stewardship Team, which updates the community about our finances, develops and leads activities like Give to the Max, Spring Giving Challenge and other efforts we haven’t thought of yet.

Are you a member of Thrivent Financial? Members can direct Thrivent dollars to Fabric and help secure $250 action grants.

Share your skills and networks— Can you write catchy marketing slogans? Do you love to edit grant proposals? Do you know reporters, podcasters, other community leaders? Do you have connections with foundations or individual donors who might support the re-imaging church? Do you love planning fundraisers? Does your employer have a matching gift program? Do you have a wealthy friend or relative who is thrilled you’re part of a church community?

If our efforts at increasing sustainable income this year fall significantly short, the Board, staff and community will need to strategize about how to align our expenses with our income.

If you have questions or would like additional information about our budget, please reach out to Fabric’s Treasurer, Laureen Harbert at laureen.tews@gmail.com.

FABRIC FINANCIAL UPDATE - SEPTEMBER 2024

Take Home Points Fiscal Year-End (September 1, 2023-August 31, 2024)

August 31, 2024 marked the end of our 2023/2024 fiscal year. Below is a snapshot of how we ended the year compared to budget.

We have made it through the first six months of our pastor transition with fairly steady attendance, steady giving, and a great response to our Spring Giving Challenge.

While in years past Fabric has been funded entirely by our community and friends of Fabric, this past year’s budget included planned use of about $11,000 savings (included in “income” above).

Additionally, we had to utilize $20K in one-time COVID-related funds and over $16,500 in reserves to fill a significant income gap due to the loss of a historically reliable $30K special gift from a friend of Fabric, as well as lower than budgeted special giving overall and autogiving. To be clear, the deficit predated Ian’s tenure.

We were fortunate to have savings to make up this shortfall, however the situation illustrates the precarity of relying on a small number of large donors for a substantial portion of our income. If circumstances for one or more of those supporters change, it has a huge impact.

Budget for 2024-2025 Fiscal Year (September 1, 2024-August 31, 2025)

Our budget for the year is just over $401K which is about 2% over last year’s budget. More than half of that increase is for potential rent increases with the recent sale of SouthSide Commons where we office. See pie charts below

We have the equivalent of 4.6 FTE staff, and personnel costs (salaries/benefits/payroll taxes) make up 80% of our expenses. We have budgeted a modest cost of living adjustment for all staff and are maintaining health benefits for full-time employees and a 4% employer retirement contribution for all staff.

To balance our budget, we are drawing down nearly $49K from our $103K balance of one-time COVID-related funds.

We are actively pursuing some promising opportunities, including grants, for new income that could fill our income gap and grow our community. We are hopeful this will result in a lower than budgeted drawn down of savings.

A major focus for Ian, the Board, the Stewardship Team and our community this year must be making significant strides in diversifying and shoring up our income, this will include opportunities for the community to learn more about our budget and a $7,500 fundraising goal for new special giving. Let us know if you have ideas to share and/or would like to join the Stewardship Team.

If our efforts at increasing sustainable income this year fall significantly short, the Board, staff and community will need to strategize about how to align our expenses with our income.

If you have questions or would like additional information about our budget, please reach out to Fabric’s Treasurer, Laureen Harbert at laureen.tews@gmail.com.

FABRIC FINANCIAL UPDATE - MARCH 2024

February 29, 2024 marked the midpoint of our 2023/2024 fiscal year. Our annual budget is just over $392K. Here’s an update of how our finances are looking.

In this year of significant transition, our budget reflected our best judgment in projecting income and expenses and the timing of our leadership transition, as well as one-time contingencies for unknowns.

Staff are managing expenses carefully. With clarity about some of the previously unknown expenses, we anticipate our actual expenses will come in under budget at year-end.

Our significant shortfall in income reflects our vulnerability in relying on large gifts from a small number of historically reliable and generous donors. Unexpected changes in the circumstances of just one can have a large impact.

We were fortunate to come into the year with a $20K balance in operating funds. With this surplus and $20K transferred from reserves, we’ve been able to cover our cash flow and have a small operating cash balance despite our income shortfall.

Autogiving has trended down during the fall/winter in the past few years, and again this year. We are $5,600 under budget in autogiving YTD, which translates to $933 under budget per month.

Looking Ahead

After more than a year of braving uncertainty about our leadership transition, Fabric has enthusiastically welcomed Ian! Our incredible staff continues to commit their energy and talent to Fabric and our community (new, returning, and long-term regulars) is deeply engaged. We are poised for growth!

As this year has demonstrated, growing a broader base of supporters at various levels of giving will provide more financial stability and make us less impacted by fluctuations in individual households.

Our yearly Spring Giving Challenge launches on April 9. We have budgeted to raise $30K in one-time gifts and increase autogiving by $1500/month with a goal of participation by 100 donors.

What You Can Do

Participate in our Spring Giving Challenge April 9-May 3! We are planning a post-Challenge celebration on May 5.

Wrestling with/wondering about your financial commitment to Fabric and/or to other organizations your values align with can be a lonely, awkward endeavor. Fabric is committed to having hard conversations, including conversations about money. If you are wrestling or have questions, email katy@fabricmpls.com.

A great thing about autogiving is that it chugs along without needing to think about it. BUT intentionally reassessing your participation in and level of autogiving at regular intervals, like during the Giving Challenge, allows you to recalibrate your commitment.

Get in touch with Fabric friends you haven’t seen recently. Invite them to join us at Field to meet Ian or to come to your Group.

Spread the word about the impact of Fabric in your life. Share ideas, livestream links, podcasts, and social media posts with others.

If you have questions or would like additional details about Fabric’s finances and budget, please feel free to reach out to Fabric Treasurer Laureen Harbert (laureen.tews@gmail.com).

FABRIC FINANCIAL UPDATE - SEPTEMBER 2023

Take Home Points Fiscal Year-End (September 1, 2022-August 31, 2023)

August 31, 2023 marked the end of our 2022/2023 fiscal year. Below is a snapshot of how we ended the year compared to budget.

*We had $20,879 in additional unbudgeted expenses and offsetting income related to the end of Greg’s sabbatical and to support Melissa’s increased role post-sabbatical as Greg spent one-quarter of his time focused on “network” activities, i.e., those related to growing and supporting more Fabric-like leaders and community.

While historically Fabric has been funded entirely by our community and friends of Fabric, this past year’s budget included planned use of some savings.

We had an extraordinarily successful Spring Giving Challenge that boosted our monthly autogiving back up to a level that helps support a sustainable budget. Thank you to the Fabric community.

We ended the year in a solid financial position.

Budget for 2023-2024 Fiscal Year (September 1, 2023-August 31, 2024)

Our balanced budget for the year is just over $392k, which is in line with last year’s budget. The pie charts below show details about 2023/2024 income and expenses.

We are entering a year of significant transition. Our budget assumptions reflect our best judgement in projecting income and expenses and the timing of our leadership transition. Additionally, we have built in one-time contingencies for unknowns.

We have budgeted a modest cost of living adjustment for all staff and are maintaining health benefits for full-time employees and a 4% employer retirement contribution for all staff.

If you have questions or would like additional information about our budget, please reach out to Fabric’s Treasurer, Laureen Harbert at laureen.tews@gmail.com.

FABRIC MINNEAPOLIS MID-YEAR FINANCIAL UPDATE

February 28, 2023 marked the midpoint of our 2022/2023 fiscal year. Our annual budget is just over $396K. Here’s an update of how our finances are looking.

While overall income is only slightly under budget, we have noticed a concerning trend with autogiving that has worsened in the last few months; monthly autogiving (which accounts for 62% of our income) averaged $600/month under budget this fall, but since January is more than $1600/month under budget. If autogiving continues at this level, we will end the fiscal year more than $16,000 in the red.

We are spending down $1,575 each month from COVID-related funds that we budgeted to 1) close a $925/month shortfall in offering and autogiving income and 2) invest in the new Nest/Sunday Site Host position.

We recently applied for and fortunately received additional one-time pandemic aid. The Board is examining scenarios for how to best use these funds to 1) plug our current structural deficit, 2) build momentum and fund needs leading up to our transition, and 3) support our new leader in implementing their vision.

*We have had $12,120 in additional unbudgeted expenses, compensated for with an equivalent income from specific fundraising, related to Greg’s sabbatical and to support Melissa’s increased role as Greg spends one-quarter of his post-sabbatical time to focus on “network” activities, i.e. those related to growing and supporting more Fabric-like leaders and communities.

Looking Ahead

Our yearly Spring Giving Challenge launches on April 11. Our goal is to have 85 folks participate with two ways to focus giving: 1) raising $30K in one-time gifts, and 2) increasing autogiving from new or current autogivers by at least by $800/month to close our deficit in this area.

As this year has demonstrated, with fewer autogivers we are more impacted by fluctuations in individual households. Building our base of autogiving support is an important part of re-engaging and rebuilding as we emerge from COVID.

What You Can Do

Participate in our Spring Giving Challenge April 11-May 5. We are planning a post-Giving Challenge community celebration on May 7th.

Reach out to Fabric friends you haven’t seen recently. Invite them to join us at Field or come to your Group.

Spread the word about the impact of Fabric in your life. Share ideas, livestream links, podcasts, and social media posts with others.

In that opening, honest, resilient space of prayer, as you understand prayer, bring what you know and value about Fabric; not to hold on with closed fists to make something happen, but to open your hands and learn what this mutual enterprise of Fabric might be all about. The result is sure to be beyond what we could ever ask or imagine on our own!

If you have questions or would like additional details about Fabric’s finances and budget, please feel free to reach out to Fabric Treasurer Laureen Harbert (laureen.tews@gmail.com).

FABRIC MPLS ANNUAL FINANCIAL UPDATE

August 31, 2022 marked the end of the 2021/22 fiscal year. As we continue to navigate COVID, we are pleased to report that we ended the fiscal year in very good shape. Our 2022/23 budget includes bright spots and strategic investments as well as areas we need to monitor closely.

Fiscal Year Sept 1, 2022-Aug 31, 2023 (see pie charts below)

Our 2022-2023 balanced budget is just over $396K and includes a 3% cost of living adjustment for all staff except Greg (at Greg’s request). It maintains health benefits for full-time staff and 4% retirement contributions for all staff.

You might remember we accrued savings during 2020 when the federal COVID Paycheck Protection Program (PPP) covered about $51K of our salary and rent expenses. We set aside those savings as we continued to monitor COVID’s impact and this year we are strategically spending some of those savings.

We have added a Sunday Site Host/Nest Coordinator position supported with some PPP-related savings. This is an investment in re-engagement and recruitment efforts with young families and high schoolers.

We are budgeting for full children’s programming and focusing on rebuilding and growing our community capacity.

A challenge we face is that the 2 ½ years of COVID have stalled the normal growth in our community and we have seen a decrease in monthly autogiving and a drastic decline in offering.

This will be a year of transition and planning for Fabric’s future. You can help Fabric remain strong and stable as well as grow to include those who aren’t a part of our community yet through your intentional involvement, serving, and financial giving. Thank you for any part you can play!

Stay tuned for our yearly autogiving check-in later in October. If you have questions or would like more information about Fabric’s budget, please contact us.

~ The Fabric Financial Stewardship Team

Take Home Points--Fiscal Year Sept 1, 2021-Aug 31, 2022

Nearly all our income is from our community members and friends. We are not funded by outside grants or organizations.

Despite COVID-related decreases in attendance and shifts back to online gathering, our focus on encouraging monthly autogiving over the past years has provided reliable cash flow.

We ended the fiscal year $11,900 to the positive. It’s highly unusual to have a surplus this size and it resulted from significantly lower than budgeted expenses due to COVID’s ongoing impact on our operations and, importantly, our very nearly meeting our income goals.

The Board is making decisions about how to direct the surplus funds to sustain and grow Fabric into the future.

Outside our regular budget, we invested in a sabbatical for Greg and a corresponding period of intentional reflection, imagining, and planning for staff and our community.

SPRING GIVING CHALLENGE SUCCESS!

Thank you & WOW! Thanks to those who contributed to our Spring Giving Challenge! YOU helped us surpass our goals by raising $31,763 with 77 participants.

FABRIC’S MID-YEAR FINANCIAL SUMMARY

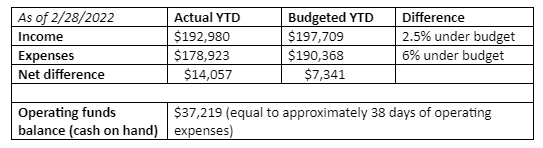

February 28, 2022 marked the midpoint of our 2021/2022 fiscal year. Our annual budget is just over $385K. Here’s an update of how our finances are looking.

We budgeted this year based on gathering as Fabric in person at Field. Several months of remote gathering this fall and winter account for the majority of our expense savings. Likewise, most of our income shortfall is in offering income, which is affected by remote gathering and lower than pre-COVID attendance at in-person gatherings.

In January, we began new retirement and Employee Assistance Program (EAP) benefits for all staff, improved health benefits for full-time employees, and made some salary increases to bring staff compensation closer to market rates. Our incredible staff is a huge reason how and why our community thrives in these challenging times. This investment in Fabric staff is critically important.

Monthly autogiving, our largest source of income (64% of budgeted income) is nearly on budget YTD. However, our number of autogiving households has dropped from a high of 68 last spring to 63 currently.

We have $167,024 in restricted savings. We release some of the restricted savings every month for operating expenses designated by donors (e.g. salary support, employee benefits, and pre-paid auto-giving) while some of the restricted savings are used only as specified expenses occur (e.g. youth camp scholarships, marketing, sabbatical funds, and emergency reserves).

Looking Ahead

With fewer autogivers, we are more impacted by fluctuations in individual households. Building our base of autogiving support is an important part of re-engaging and rebuilding as we emerge from COVID.

Our yearly Spring Giving Challenge launches on April 24. We have budgeted to raise $30K in one-time gifts with a goal of participation by 75 donors.

During Greg’s sabbatical this summer, we will continue to pay Greg’s salary and benefits out of our operating budget. Additional expenses related to the sabbatical are being paid for with funds raised specifically for the sabbatical and other restricted funds. Read more here.

What You Can Do

Participate in our Spring Giving Challenge. We are planning a post-Giving Challenge community celebration in May.

If our Autogiving Check-in fell off your radar or happened at a difficult time for you, this is another chance to assess your participation in and level of autogiving.

Reach out to Fabric friends you haven’t seen recently. Invite them to join us at Field or come to your Group.

Spread the word about the impact of Fabric in your life. Share ideas, livestream links, podcasts, and social media posts with others.

If you have questions or would like additional details about Fabric’s finances and budget, please feel free to reach out to Fabric Treasurer Laureen Harbert (laureen.tews@gmail.com).

FABRIC MINNEAPOLIS ANNUAL FINANCIAL SUMMARY

August 31, 2021 marked the end of the 2020/21 fiscal year. In a year heavily impacted by COVID, we are pleased to report that we ended the year slightly to the positive. Our 2021/22 budget has bright spots and also some areas of concern.

Take Home Points—Fiscal Year Sept 1, 2020-Aug 31, 2021

First, it is important to note that nearly all our income is from our community members and friends. We are not funded by outside grants or organizations.

Our $390K budget assumed in-person gathering and normal operations. In reality, we gathered in person only the last three months of the year.

Our total income was about $30,800 below target, primarily due to 1) lower than budgeted autogiving income, and 2) the lack of Sunday offering. Our expenses were also down by about $33,100, because we didn’t have costs associated with Sunday in-person gathering (rent and engineers at Field, Nest coordinator, normal scale children’s ministry). We therefore ended the year $2,300 to the positive.

We spent nearly $13,300 for a big marketing effort and $1,200 for capital investments related to music/sound equipment needed for our virtual gatherings. These expenses were in addition to our regular budgeted expenses above and were paid for out of funds given specifically for these purposes.

Looking Ahead—Fiscal Year Sept 1, 2021-Aug 31, 2022

The $385K balanced budget for the new fiscal year assumes gathering in person at Field.

The most exciting part of the budget is that it incorporates new retirement and Employee Assistance Program (EAP) benefits for all staff, and improved health benefits for full-time employees. It also includes some some salary increases to move salaries closer to market rate. Our staff are a huge part of why and how our community thrives through this complicated life and investing in staff ensures our budget reflects this.

A challenge in the current budget is that we had to scale back our projected autogiving income based on current trends. Autogiving is 64% of our budgeted income and in the 2020/21 fiscal year autogiving was 6.6% under budget or approximately $1400/month short.

Because of our investment in lights and sound equipment at Field a few years ago, our budget for this year includes seven months of free rent at Field, which allowed us to balance the budget.

The COVID pandemic has created a long stretch of difficulty and uncertainty for all of us, including Fabric. We do have reserves to help us through the bumps if needed, but in the long term, we will need to increase our income to keep Fabric financially healthy. You can help Fabric remain strong and stable through your intentional involvement, serving, and financial giving. Thank you for any part you can play!

Stay tuned for our yearly autogiving check-in during October. If you have questions or would like more information about Fabric’s budget, please contact us.

~The Fabric Minneapolis Board

Previous Financial Updates…

February 28, 2021 marked the midpoint of our current fiscal year (September 1, 2020-August 31, 2021). Our annual budget is just under $390K. Here’s an update of how our finances are looking.

We budgeted this year based on gathering as Fabric in person. This budget assumption was the most conservative approach because our expenses are higher when we gather in person and it also reflects what a “normal” operating budget is.

Gathering remotely accounts for the vast majority of our expense savings and about half of our income shortfall (i.e. offering income).

Monthly autogiving, our largest source of income (66% of budgeted income) has averaged about $1,100/month below budget at $20,200/month. Our Fall Autogiving Check-In resulted in a $459/month increase. We had budgeted a $1500/month increase.

Our $51,658 Paycheck Protection Program (PPP) federal loan, to offset potential loss of income related to COVID-19, was 100% forgiven. Because of the PPP loan, we were able to set aside some of our regular income. Fabric is exploring creative ways to use this money to benefit our community, and it will not simply be added to our savings. Your input will be valuable in the coming months. Stay tuned!

Our Annual Giving Challenge launches on April 8. We have budgeted to raise $25K in one-time gifts with a goal of participation by 100 donors.

What Can You Do

If our Autogiving Check-In fell off your radar or happened at a difficult time for you, this is another chance to assess your participation in and level of autogiving. Learn more about Giving here.

Participate in our April Giving Challenge. New this year, we’ll have awesome thank you prizes for attending Sunday zoom gatherings during the Challenge!!

Join us for What’s Up With Fabric on April 22 to share your ideas, hear updates, and perhaps win a thank you prize!

Spread the word about the impact of Fabric in your life. Share ideas, podcasts, and social media posts with others. Our virtual Easter livestream on April 4 will be fun and easily shareable.

Autogiving Check-In Update & Quick Financial Update (November 2020)

In November, we asked our community to take stock of their giving and consider a “sign up or bump up” challenge for monthly autogiving. As of the end of December, we’ve seen an increase of $459/month in autogiving from 4 new/returning autogivers and 6 current autogivers who increased their monthly gift. Thank you! If this check-in opportunity fell off your radar or didn’t register at all, we understand. After all, there was an election, a COVID surge and further lock-down, distance learning, etc. Good news! It’s not too late! Now is as good a time as any to reassess. And remember, a monthly gift of $10 or an increase of $10/month adds up when many people participate! Find out how here.

Our financials are in good shape so far this fiscal year. We budgeted for normal in-person operations to be conservative, so our expenses are $13,000 under budget. Our income is also $6,500 under budget, largely because we don’t have offering income, but also because automated giving is about 4% lower than budgeted. We’ll provide a full financial update in March, at the halfway point of our fiscal year. As always, reach out to Katy or Fabric Treasurer, Laureen Harbert if you’d like additional information.

The Fabric fiscal year ended on August 31 and we are pleased to say that we closed in good financial condition. We are also keenly aware that we are in the midst of the Coronavirus pandemic and have challenges ahead as a community, as you do individually. If you'd like more information about the Fabric budget, please contact Katy

First, it is important to note that nearly all our income is from our community members and friends. We are not funded by outside grants or organizations.

Our total income was just under $10,000 below target, largely due to the lack of Sunday offerings from in person gatherings starting mid-March. However, our expenses were also down by about $17,000, mostly because of not paying Minneapolis Public Schools to rent our Sunday space. We therefore ended a year that was heavily impacted by COVID-19 $7,284 to the positive. That is 2% of our 2019-2020 budget of $380,000.

Automated Giving is our most important and reliable source of income, representing nearly 2/3s of our income. This form of giving helps us balance out the ebb and flow of attendance in normal years and has been even more important during the pandemic. While Auto-Giving increased slightly this past year it was about 3% under budget. We will be looking to bump up the total Auto-Giving again this year through new people entering the community and existing Fabric folks re-evaluating their commitments. There will also be a Giving Challenge in the spring as in previous years. This accounts for a significant amount of our remaining income.

We ended the year with about $83,000 in Savings. $28,000 of that is a reserve account we are building for emergencies. The rest is dedicated money that was given over the years for innovation projects, marketing, special capital expenses, event scholarships, etc. We also have an additional $47,000 in savings from givers who make an annual rather than monthly gifts. 1/12th of these gifts is transferred each month to our checking account for expenses.

Fabric received a Paycheck Protection Program (PPP) loan of $51,658 which we expect will be 100% forgiven. That money had to be used for payroll, rent and similar expenses during the specified timeframe, but that meant we did not have to expend those same monies from our regular accounts. We have therefore set that same amount aside in a dedicated account (not included in the savings discussed above) to use if we are notably financially affected by the pandemic. If not, we will work with the community to discern how to steward any unused portion consistently with our mission and the purpose of the PPP loan.

Our FY2021 budget is a maintenance budget. There are no salary increases or cost of living adjustments in the budget.

Thank you for your part in Fabric’s financial well-being. Everyone’s participation matters. It is not about how much you give but that you are a part of our financial life with everyone else. If you have questions or would like more information about Fabric’s budget, please contact us.

What Can You Do

Reassess or begin your auto-giving: This fall we have a goal of increasing our monthly auto-giving by $1500. Be a part of that by signing up with your bank to auto-give. Find out more information HERE.

Let us know if you’re a Thrivent Member so we can connect with you about Thrivent Action Grants and Thrivent Choice dollars.

Spread the word about the impact of Fabric in your life. Share ideas, podcasts, and social media posts with others, and invite them to your Group or to meet you on a Sunday morning.

Currently our community giving profile feels a bit out of balance – picture a leaning Jenga game tower with a narrow base that can teeter if a few pieces are pulled out. Reshaping that unstable Jenga tower into more of a solid stable cube will make Fabric more financially sustainable for the future. Watch this video, to learn more about where we are and where we are going.

September 1, 2019 marked the start of our 2019/2020 fiscal year. Here’s an update of how we fared in the 2018/2019 fiscal year and what’s coming up for 2019/2020.

2018/2019 Summary:

All but $540 of our income was given by the Fabric community and friends of Fabric.

Monthly autogiving averaged $20,348 June-August 2019 vs $19,332 for the same three months in 2018; however, the number of households participating in autogiving dropped from 78 to 68.

We saw drops in offering income in the last half of the fiscal year, which is due in part to increased autogiving income.

The Board committed to a salary increase for non-clergy staff (almost entirely supported by ongoing targeted giving) and to providing compensation intended to partially offset health insurance costs for ¾ time staff.

We invested in some long-needed light and sound upgrades at Field Community School. In exchange for Fabric fronting the cost of that equipment, Minneapolis School District will provide 16+ months of free rent at Field.

2019/2020 BUDGET

We have a $379,000 budget for 2019/2020, a 5% increase over 2018/2019.

The budgeted increase in expenses will cover slight increases in our regular costs and the staff salary and health insurance improvements made partway through the 2018/2019 fiscal year.

The budgeted increase in income is expected to come primarily from the Fabric community (some of which is already part of our restricted savings) as well as from interest on our savings and from Thrivent Action Grants.

Our initial budget had about a $5,000 shortfall. We closed the gap by revising our originally budgeted offering income upward. This stretch goal aligns with the Board’s focus on increasing the reach of Fabric. As always we will monitor carefully actual vs. budgeted income and expenses and provide updates to the community.

Based on feedback from the community, the budget reflects a restructuring of the annual giving challenge (watch for more information coming soon!).

While we will have free rent at Field this year because of our capital investment in light and sound equipment, we will use the monthly savings to replenish the reserves used to pay for those upgrades.

I love this opportunity to combine an incredible Vampire movie set in 1930s Mississippi Delta, historical and spiritual context and a dinner table of people to process and learn with!